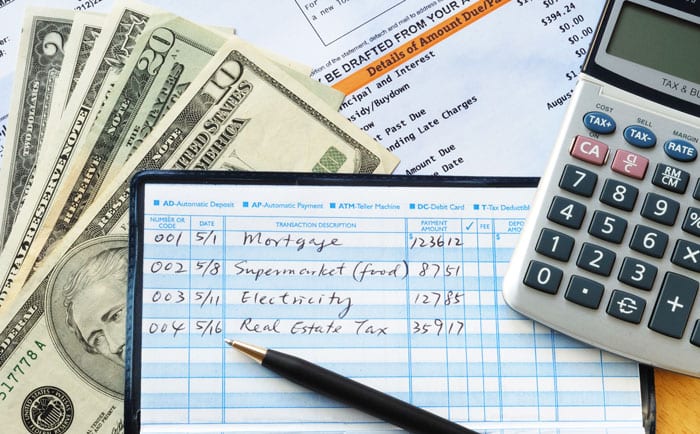

Discover how to seamlessly integrate discount gift cards into your monthly budgeting plans.

Welcome back to the CardDepot.com blog! Are you ready to take your budgeting skills to the next level and unlock the power of discount gift cards? In this comprehensive guide, we will show you how to seamlessly integrate discount gift cards into your monthly budgeting plans, allowing you to plan your purchases strategically and maximize your savings. Let's dive in!

Step 1: Assess Your Spending Habits

The first step in creating a budget that includes discount gift cards is to assess your current spending habits. Look closely at your monthly expenses, including groceries, dining out, entertainment, and other discretionary purchases. Identify areas where you can potentially save money by leveraging discount gift cards for your favorite retailers and service providers.

Step 2: Set Your Budgeting Goals

Next, set clear budgeting goals that align with your financial priorities and objectives. Determine how much you want to allocate towards essential expenses, savings, and discretionary spending each month. Remember that discount gift cards can help you stretch your budget further, allowing you to save money on everyday purchases and allocate more funds towards your financial goals.

Step 3: Research Available Deals and Discounts

Once you've established your budgeting goals, it's time to research available deals and discounts on discount gift cards. Keep an eye out for promotions, sales, and special offers from trusted sources. By staying informed about the latest deals, you can plan your purchases around available discounts and maximize your savings on essential items and indulgences alike.

Step 4: Plan Your Purchases Strategically

With a clear understanding of your spending habits, budgeting goals, and available deals, it's time to plan your purchases strategically. Consider which expenses can be covered by discount gift cards and prioritize your spending accordingly. Whether you're stocking up on groceries from Instacart, dining out with friends at Domino’s, or treating yourself to a spa day, leveraging discount gift cards allows you to stretch your budget further and get more value for your money.

Step 5: Track Your Spending and Adjust as Needed

Finally, track your spending regularly and adjust your budget as needed to stay on track with your financial goals. Monitor your expenses, review your budgeting plan periodically, and make adjustments as necessary to ensure that you're making the most of your discount gift cards and maximizing your savings potential.

Conclusion

By integrating discount gift cards into your monthly budgeting plans, you can take control of your finances, save money on your purchases, and make the most of every dollar you spend. Follow these simple steps to craft a budget that includes discount gift cards, and start enjoying the benefits of smart spending today!